Financial fraud has evolved dramatically in the digital age, becoming more sophisticated, widespread, and damaging than ever before. As cybercriminals develop increasingly advanced techniques, traditional rule-based fraud detection systems are struggling to keep pace. Enter artificial intelligence—a game-changing technology that's revolutionizing how banks and financial institutions protect their customers and assets. This article explores how AI-powered fraud detection works, its benefits, and what consumers need to know about this emerging technology.

The Growing Threat of Financial Fraud

Before diving into AI solutions, it's important to understand the scale and evolution of financial fraud:

- Global financial fraud losses exceed $30 billion annually

- The average data breach costs financial institutions $5.85 million

- Online banking fraud increased by 250% between 2019 and 2023

- Over 60% of consumers have experienced some form of payment fraud attempt

Traditional fraud detection methods relied on static rules and threshold-based triggers. While effective against known fraud patterns, these systems struggle with:

- Detecting novel fraud techniques

- Adapting to changing criminal behaviors

- Minimizing false positives that frustrate legitimate customers

- Processing the massive volume of transactions in real-time

"The sophistication of financial fraud has increased exponentially. Criminals now operate with organized precision, leveraging data breaches and social engineering to conduct highly targeted attacks that easily bypass traditional security measures."

— Dr. Andrew Parker, Cybersecurity Researcher

How AI is Transforming Fraud Detection

Machine Learning Models

At the core of AI-powered fraud detection are sophisticated machine learning models that can:

- Analyze thousands of data points per transaction in milliseconds

- Identify subtle patterns invisible to human analysts

- Learn and adapt to new fraud techniques without explicit programming

- Balance security with customer experience by reducing false positives

These systems typically employ several types of machine learning approaches:

Supervised Learning

These models are trained on labeled historical data where transactions are already classified as fraudulent or legitimate. They learn to recognize patterns associated with fraud and apply this knowledge to new transactions.

Unsupervised Learning

These models identify anomalies by detecting transactions that deviate from normal patterns, even without prior examples of specific fraud types. This approach is particularly valuable for identifying previously unknown fraud techniques.

Deep Learning

Neural networks with multiple layers can identify extremely complex patterns in transaction data, enabling detection of sophisticated fraud schemes that utilize multiple accounts or transactions.

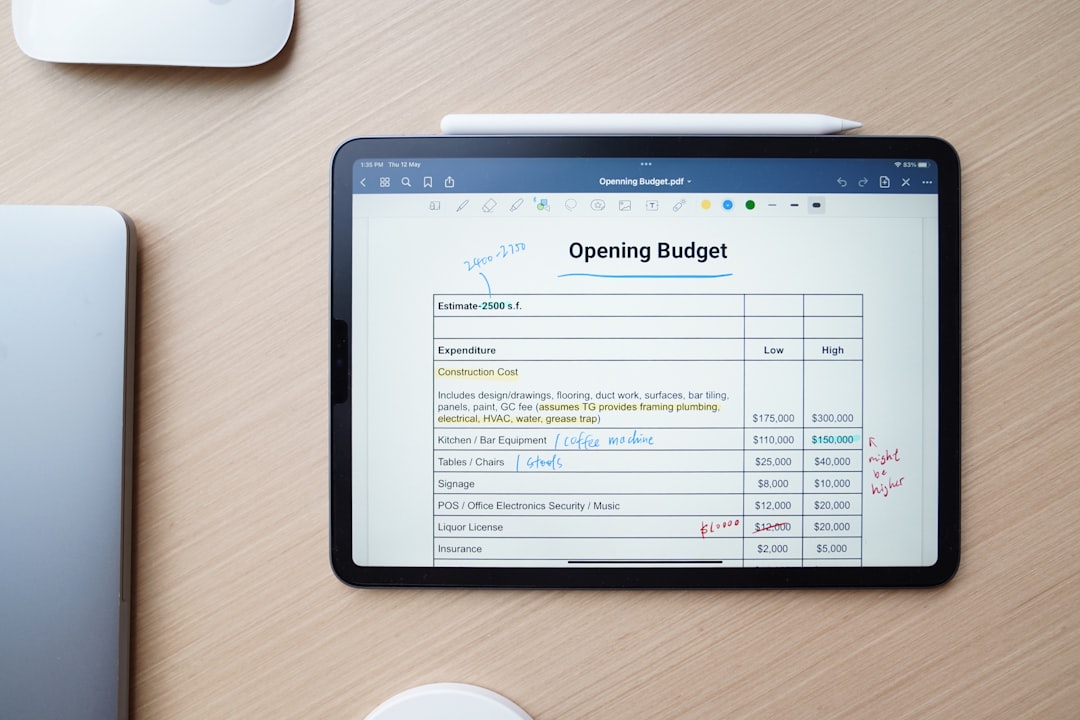

Visualization of how AI analyzes transaction patterns to identify potential fraud.

Behavioral Biometrics

Beyond transaction data, advanced AI systems incorporate behavioral biometrics to verify user identity by analyzing:

- Typing patterns and speed

- Mouse movement characteristics

- Screen navigation habits

- Device handling patterns on mobile

These unique behavioral "fingerprints" are extremely difficult for fraudsters to replicate, adding an additional layer of security that functions invisibly in the background without creating friction for legitimate users.

Network Analysis

AI systems can map relationships between accounts, devices, and transactions to identify fraud rings and coordinated attacks:

- Detecting multiple accounts controlled by the same entity

- Identifying money laundering patterns across seemingly unrelated accounts

- Mapping connections between known fraudulent actors and new accounts

This network perspective allows banks to take preemptive action against entire fraud operations rather than just individual transactions.

Real-World Applications and Benefits

Card Fraud Detection

Credit and debit card fraud remains one of the most common financial crimes. AI systems protect cardholders by:

- Building personalized spending profiles for each customer

- Identifying transactions that deviate from normal patterns

- Evaluating hundreds of risk factors in real-time (location, merchant type, amount, etc.)

- Adapting to changing customer behaviors without triggering false alarms

A major credit card company reported reducing fraud losses by 73% after implementing AI detection systems while simultaneously decreasing false positives by 50%—improving both security and customer experience.

Account Takeover Protection

Account takeover (ATO) attempts occur when criminals gain unauthorized access to banking accounts. AI counters this threat by:

- Analyzing login behavior for suspicious patterns

- Detecting unusual device or location information

- Identifying atypical session activities once logged in

- Monitoring unusual changes to account settings or information

"Our AI system detected and prevented an account takeover attempt that bypassed traditional security measures. The attack used the correct credentials but exhibited subtle behavioral differences from the legitimate customer—differences only AI could detect in real-time."

— Maya Rodriguez, Digital Security Officer at Global Banking Group

Application Fraud Prevention

Synthetic identity fraud—where criminals create fictional identities using a combination of real and fake information—has become increasingly common. AI helps prevent this by:

- Cross-referencing application data against multiple databases

- Detecting patterns consistent with synthetic identities

- Identifying connections between new applications and known fraud cases

- Evaluating the consistency and coherence of applicant information

This proactive approach stops fraud before accounts are even created, saving banks billions in potential losses.

A modern AI-powered fraud prevention dashboard showing real-time threat detection.

Real-Time Payment Monitoring

With the rise of instant payment systems, banks have mere seconds to evaluate transaction risk. AI systems excel in this environment by:

- Processing vast amounts of data in milliseconds

- Adapting risk thresholds based on transaction context

- Distinguishing between genuine changes in customer behavior and suspicious activity

- Implementing appropriate verification steps only when necessary

This capability is particularly important as customers increasingly expect instant transfers while maintaining security.

Challenges and Considerations

The False Positive Balance

One of the biggest challenges in fraud detection is balancing security with customer convenience. False positives—legitimate transactions flagged as suspicious—create significant problems:

- Customer frustration and potential abandonment

- Increased operational costs for customer service

- Lost transaction revenue

AI systems must continuously optimize this balance, increasing security without creating undue friction for legitimate customers. The most advanced systems now achieve false positive rates below 1:1000 while maintaining detection rates above 95%.

Explainability and Regulatory Compliance

Financial institutions face strict regulatory requirements regarding automated decision-making. When an AI system flags a transaction as fraudulent, banks must be able to explain why. This creates challenges with complex "black box" AI models.

The industry is addressing this through:

- Developing "explainable AI" approaches that provide clear reasoning

- Creating hybrid systems that combine AI detection with human review

- Implementing robust governance frameworks for AI decision-making

- Maintaining comprehensive audit trails for all fraud determinations

Data Privacy Concerns

Effective AI fraud detection requires extensive data, raising privacy concerns among consumers and regulators. Financial institutions must balance security needs with privacy rights by:

- Implementing robust data anonymization techniques

- Clearly communicating how customer data is used

- Providing options for customers to control their data

- Ensuring compliance with regulations like GDPR and CCPA

The most successful institutions view privacy not as an obstacle but as a complementary goal to security—both aimed at protecting customers.

What Consumers Should Know

Understanding False Declines

When your transaction is declined due to suspected fraud, remember:

- This is a protective measure, not a punishment

- Responding promptly to verification requests helps train the AI system

- Keeping your contact information updated ensures you can receive alerts

- Notifying your bank before unusual transactions (travel, large purchases) can reduce false alarms

Supporting Your Bank's AI Systems

Consumers can help improve AI fraud detection by:

- Promptly reporting suspicious activity

- Responding to fraud alerts quickly and accurately

- Keeping contact information and travel notifications up to date

- Using bank-provided security features like transaction alerts

This collaborative approach creates a feedback loop that improves the AI system's accuracy over time.

Privacy Rights and Options

While AI fraud detection requires data analysis, consumers should know:

- Most systems use anonymized or tokenized data where possible

- You have the right to understand how your data is being used

- Financial institutions should provide clear privacy policies

- You can typically opt out of certain data uses (though this may impact protection)

Being informed about your rights enables you to make appropriate choices about your financial data.

The Future of AI in Fraud Prevention

Continuous Learning Systems

Next-generation AI fraud systems will feature continuous learning capabilities that:

- Update models in near real-time as new fraud patterns emerge

- Adapt to individual customer behavior changes without manual intervention

- Share threat intelligence across institutions while preserving privacy

- Self-optimize performance metrics to balance security and experience

Cross-Channel Integration

Future systems will provide unified fraud protection across all banking channels:

- Coordinated monitoring across mobile, web, in-person, and call center interactions

- Consistent security measures regardless of how customers engage

- Channel-specific risk factors incorporated into a holistic view

- Seamless customer experience despite robust security measures

Biometric Authentication Evolution

Biometric verification will continue to evolve beyond fingerprints and facial recognition:

- Voice pattern authentication that detects subtle speech characteristics

- Passive behavioral biometrics that continuously verify identity during sessions

- Multi-modal approaches combining multiple biometric factors

- Liveness detection to prevent spoofing of biometric factors

These advances will make authentication both more secure and more convenient for legitimate users.

Conclusion

AI-powered fraud detection represents one of the most significant advances in financial security in decades. By leveraging machine learning, behavioral analytics, and network analysis, financial institutions can now:

- Detect and prevent sophisticated fraud attempts in real-time

- Adapt to evolving criminal techniques without manual updates

- Reduce false positives that frustrate legitimate customers

- Provide more secure yet frictionless banking experiences

As these systems continue to evolve, the partnership between financial institutions, technology providers, and customers will be crucial. By understanding how AI fraud detection works and actively participating in security measures, consumers can help create a more secure financial ecosystem for everyone.

The future of financial security lies not in creating more barriers, but in developing smarter systems that can distinguish legitimate activity from fraud with unprecedented accuracy—protecting customers while enhancing their banking experience.