Investment management has traditionally been a service reserved for the wealthy, with high minimum investments and substantial management fees. However, the financial landscape is changing dramatically with the emergence of robo-advisors—automated investment platforms powered by artificial intelligence. These digital wealth managers are democratizing access to sophisticated investment strategies and reshaping the future of personal finance. In this article, we'll explore the rise of robo-advisors and their impact on investment management.

What Are Robo-Advisors?

Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning and investment management with minimal human supervision. These systems use sophisticated software to:

- Analyze investor goals, risk tolerance, and time horizons

- Construct diversified portfolios based on modern portfolio theory

- Automatically rebalance investments to maintain optimal asset allocation

- Implement tax-efficient strategies like tax-loss harvesting

Unlike traditional financial advisors who might require clients to have $250,000 or more in investable assets, many robo-advisors allow investors to start with as little as $500—or in some cases, no minimum at all.

The Evolution of Robo-Advisory Services

First Generation: Basic Automation

When robo-advisors first emerged around 2008, they offered simple automation of passive investment strategies. These early platforms provided:

- Automated portfolio construction using ETFs

- Basic rebalancing capabilities

- Significantly lower fees than human advisors

While revolutionary at the time, these platforms lacked personalization and were primarily focused on implementing standard index investing approaches.

Second Generation: Enhanced Personalization

The next wave of robo-advisors introduced more sophisticated features:

- Goal-based investing tailored to specific financial objectives

- Tax-optimization strategies

- Integration with other financial accounts

- Hybrid models with limited human advisor access

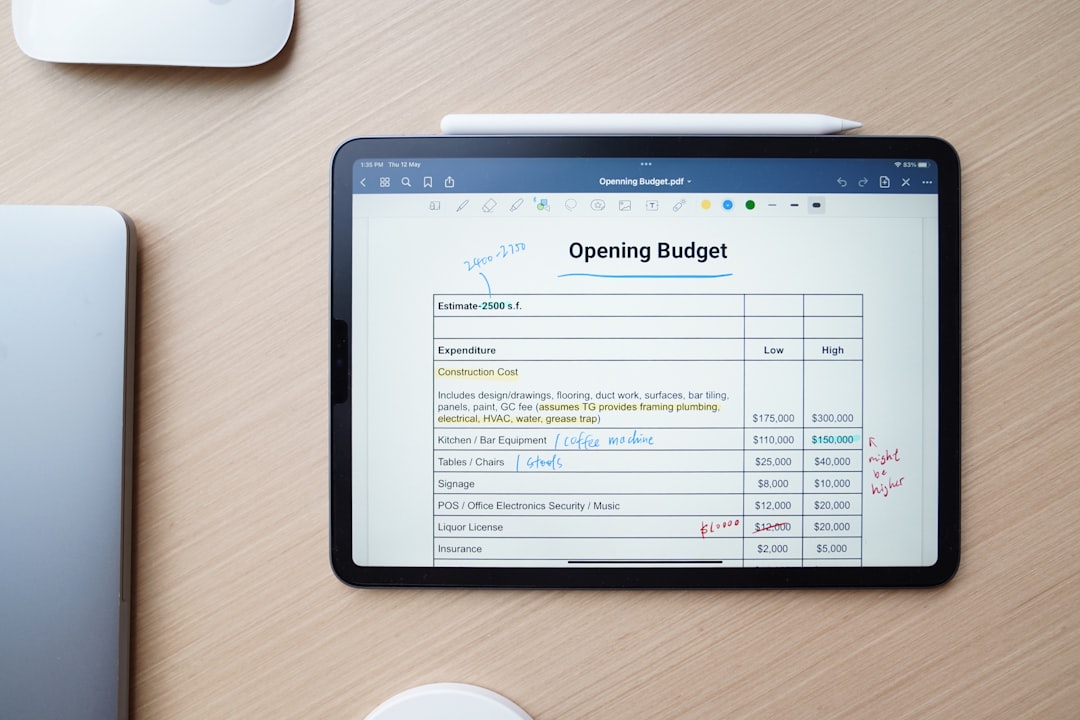

A modern robo-advisor interface showing portfolio allocation and performance metrics.

Third Generation: AI-Powered Intelligence

Today's most advanced robo-advisors leverage sophisticated artificial intelligence to deliver highly personalized investment experiences:

- Machine learning algorithms that adapt to changing market conditions

- Natural language processing for conversational interfaces

- Behavioral finance insights to guide investor decisions

- Predictive analytics for proactive financial planning

"The combination of AI capabilities with investment management has created unprecedented access to sophisticated financial services. What once required millions in assets and personal connections to elite firms is now available to everyday investors through their smartphones."

— Dr. Elena Petrova, Financial Technology Researcher

How AI Powers Modern Robo-Advisors

Risk Assessment and Portfolio Construction

AI-powered risk assessment goes far beyond traditional questionnaires. Modern systems analyze:

- Financial behavior patterns across accounts

- Spending habits and cash flow trends

- Reactions to market volatility

- Life stage and potential future needs

This comprehensive analysis enables the creation of truly personalized portfolios that align with both stated and revealed preferences.

Market Analysis and Dynamic Asset Allocation

While traditional robo-advisors relied on static models, AI-enhanced platforms can:

- Process vast amounts of market data in real-time

- Identify subtle correlations between asset classes

- Adjust allocations based on changing market conditions

- Incorporate alternative data sources like social sentiment

These capabilities allow for more responsive portfolio management without abandoning the core principles of long-term investing.

Behavioral Coaching and Decision Support

Perhaps the most valuable contribution of AI in robo-advisory services is addressing the human element of investing:

- Identifying emotional decision patterns that may harm returns

- Providing contextual guidance during market volatility

- Personalizing communication based on investor behavior

- Nudging investors toward better long-term decisions

This behavioral coaching—traditionally a key value proposition of human advisors—is now being effectively delivered through AI-powered interfaces.

An example of how robo-advisors use behavioral coaching to guide investors during market volatility.

The Impact on Investment Management

Democratization of Wealth Management

The most significant impact of robo-advisors has been expanding access to professional investment management:

- Lower minimum investments (often $500 or less)

- Reduced fees (typically 0.25%-0.50% versus 1%-2% for traditional advisors)

- Accessible digital interfaces available 24/7

- Educational content integrated into the user experience

This democratization is bringing millions of new investors into the market who previously had limited options beyond basic savings accounts or self-directed trading.

Fee Compression and Industry Transformation

The competitive pressure from robo-advisors has forced the entire wealth management industry to evolve:

- Traditional firms launching their own digital platforms

- Hybrid models combining technology with human advisors

- Greater transparency in pricing and services

- Increased focus on value-added services beyond investment management

"Five years ago, our firm charged 1.5% for portfolio management. Today, we charge 0.8% and provide significantly more services, including comprehensive financial planning and tax coordination. This evolution was directly driven by the competitive pressure from robo-advisors."

— James Wilson, Managing Partner at Legacy Wealth Advisors

Enhanced Investment Outcomes

Research suggests that robo-advisors may improve investor outcomes through:

- Consistent implementation of disciplined investment strategies

- Reduction of behavioral biases that lead to poor timing decisions

- More efficient tax management

- Lower overall investment costs

A 2023 study by Morningstar found that investors using robo-advisors experienced returns approximately 0.4% higher annually than self-directed investors with similar risk profiles, primarily due to behavior management and consistent rebalancing.

Limitations and Challenges

Complex Financial Planning Needs

Despite their sophistication, robo-advisors still face limitations when addressing:

- Complex estate planning situations

- Business ownership considerations

- Intricate tax scenarios

- Emotionally complex financial decisions (like inheritance or divorce)

These situations often benefit from human judgment and emotional intelligence that AI has not yet fully replicated.

Market Concentration Risk

As robo-advisors continue to grow, potential systemic risks emerge:

- Concentration of assets in similar investment strategies

- Potential for cascading selling during market stress

- Limited differentiation in portfolio construction

Regulators are increasingly examining these risks as the robo-advisory industry expands its market share.

Trust and Human Connection

Perhaps the most significant challenge for robo-advisors remains the human element:

- Building trust in algorithmic decision-making

- Providing reassurance during market downturns

- Creating meaningful connection through digital interfaces

This explains the growing popularity of hybrid models that combine technological efficiency with human engagement.

The Future of Robo-Advisory Services

Expanded Capabilities

The next generation of robo-advisors will likely feature:

- More holistic financial planning incorporating insurance, estate planning, and debt management

- Integration with other financial services like banking and lending

- Enhanced personalization through deeper data integration

- More sophisticated alternative investment options

Convergence with Traditional Advisory Models

The line between robo-advisors and traditional wealth management will continue to blur:

- Traditional firms adopting more technology

- Robo-advisors adding more human elements

- Tiered service models based on complexity and assets

This convergence will likely create a spectrum of options rather than a binary choice between human or algorithm.

Global Expansion and Financial Inclusion

Perhaps the most exciting frontier is the potential for robo-advisors to expand globally:

- Bringing investment management to underserved markets

- Adapting to different regulatory environments

- Customizing for cultural differences in financial attitudes

- Potentially reaching billions of new investors

Conclusion

The rise of robo-advisors represents one of the most significant transformations in investment management in generations. By combining artificial intelligence with financial expertise, these platforms are:

- Democratizing access to sophisticated investment strategies

- Reducing costs across the industry

- Improving investor behavior and outcomes

- Creating new models for financial advice delivery

While challenges remain, the trajectory is clear: AI-powered investment management is not just a passing trend but a fundamental shift in how financial services are delivered. As these platforms continue to evolve, they will likely play an increasingly important role in helping individuals achieve their financial goals—regardless of their wealth or investment knowledge.

For investors considering whether to use a robo-advisor, the decision should be based on their specific needs, comfort with technology, and the complexity of their financial situation. Many will find that the optimal solution may be a combination of automated services for core investment management complemented by human advice for more complex planning decisions.