In today's fast-paced financial world, keeping track of your spending and planning for the future can be challenging. Fortunately, artificial intelligence has revolutionized personal finance management, offering sophisticated tools that can analyze your spending patterns, predict future expenses, and provide personalized recommendations. In this article, we'll explore the top 5 AI-powered budgeting tools that are making waves in 2024.

1. FinanceBrain Pro

FinanceBrain Pro stands out as the most comprehensive AI budgeting solution on the market today. Using natural language processing and machine learning algorithms, it not only categorizes your transactions automatically but also learns from your corrections to improve its accuracy over time.

Key Features:

- Advanced transaction categorization with 98.7% accuracy

- Predictive cash flow analysis that forecasts your financial situation up to six months ahead

- Smart saving recommendations based on your spending patterns

- Bill negotiation feature that identifies opportunities to lower recurring expenses

What sets FinanceBrain Pro apart is its "financial health score" that provides a holistic view of your financial wellbeing, considering factors like savings rate, debt-to-income ratio, and investment diversification. The app then offers actionable steps to improve this score over time.

"Since implementing FinanceBrain Pro into my financial routine, I've saved an additional $320 per month that I didn't even realize was slipping through the cracks. The predictive alerts have been particularly helpful in avoiding overdraft fees."

— Marcus Chen, Software Engineer

2. BudgetAI

BudgetAI takes a different approach by focusing on behavioral psychology. This tool analyzes not just what you spend but why you spend, identifying emotional triggers and helping users develop healthier financial habits.

Key Features:

- Spending pattern analysis that identifies emotional and impulse purchases

- Custom budget categories that adapt to your lifestyle

- AI coach that provides personalized motivation and financial education

- Goal-based saving plans with visual progress tracking

BudgetAI particularly excels at helping users break negative spending cycles. Its "pause before purchase" feature uses predictive analytics to identify when you're about to make an impulse buy and sends a gentle reminder to consider whether the purchase aligns with your financial goals.

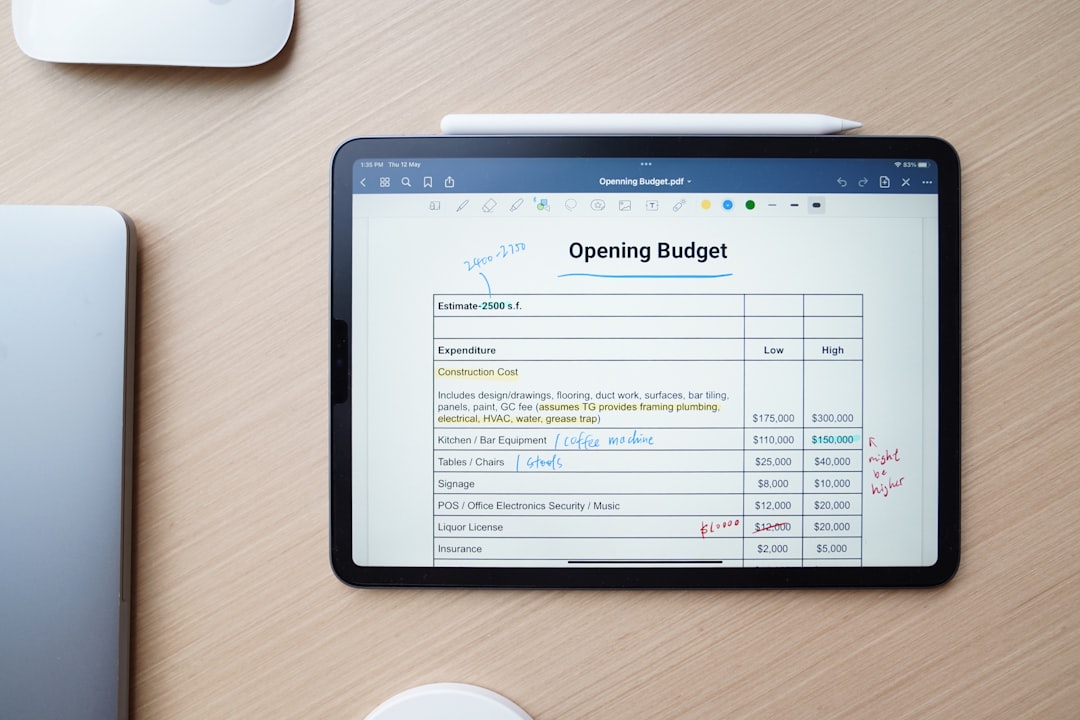

BudgetAI's intuitive dashboard provides visual breakdowns of spending patterns.

3. WealthPilot

WealthPilot integrates budgeting with investment management, offering a comprehensive approach to financial planning. Its AI algorithms not only help you manage daily expenses but also optimize your investment strategy based on your financial goals and risk tolerance.

Key Features:

- Unified view of accounts, investments, and expenses

- Tax-optimized investment recommendations

- Retirement planning scenarios with AI-generated projections

- Automated expense ratio analysis to minimize investment fees

What makes WealthPilot particularly valuable is its ability to simulate different financial scenarios. For example, it can show how increasing your savings rate by 2% might affect your retirement timeline or how purchasing a home might impact your long-term financial health.

4. SmartSpend

SmartSpend specializes in real-time financial insights, making it ideal for users who want immediate feedback on their spending decisions. This app uses AI to analyze merchant data, price comparisons, and your personal spending habits to help you make more informed purchasing decisions.

Key Features:

- Real-time purchase analysis with instant feedback

- Price comparison tool that suggests better deals on frequent purchases

- Subscription tracking that identifies unused or overlapping services

- Cashback optimization that suggests the best payment method for each purchase

SmartSpend's most innovative feature is its "what if" scenario planner that allows you to see the long-term impact of potential purchases. Before buying that new smartphone or booking a vacation, you can visualize how it will affect your savings goals and monthly budget.

"The subscription tracking feature alone saved me $75 monthly by identifying services I had forgotten about. The real-time feedback has completely changed how I approach shopping."

— Jennifer Lopez, Marketing Director

5. FamilyFinance AI

FamilyFinance AI addresses a gap in the market by focusing specifically on family financial management. This tool allows multiple users to collaborate on household finances while maintaining individual privacy for personal expenses.

Key Features:

- Multi-user dashboard with customizable privacy settings

- Child expense tracking and allowance management

- Educational components that teach financial literacy to younger users

- Future expense prediction for growing families (education costs, housing needs, etc.)

What distinguishes FamilyFinance AI is its ability to grow with your family. The platform adapts its recommendations and features based on family milestones like having children, buying a home, or planning for college expenses.

FamilyFinance AI's collaborative budget interface allows family members to work together while maintaining privacy.

Conclusion

The evolution of AI-powered budgeting tools has transformed financial management from a tedious chore into an intuitive process that can actually improve your financial health. Each of these top 5 tools offers unique strengths:

- FinanceBrain Pro provides the most comprehensive overall financial management

- BudgetAI excels at changing financial behaviors

- WealthPilot offers the best integration between budgeting and investing

- SmartSpend delivers superior real-time insights

- FamilyFinance AI is unmatched for household financial collaboration

When choosing the right tool for your needs, consider your specific financial goals, the complexity of your financial situation, and which features would most benefit your personal financial journey. With the right AI budgeting tool in your corner, you'll be well-equipped to make smarter financial decisions and build a more secure future.